The Planner Blog

Lights, Camera, Action on Tax Savings: Are Tools Deductible for Commercial Videographers?

You've probably found yourself staring at the latest videography gear, asking:

"Are tools deductible?” We’ve got answers - read on to learn more!

What’s the Difference Between a CPA and a Tax Attorney?

When it comes to taxes, the landscape can be confusing. Accountants and attorneys have different roles when it comes to helping you navigate the complexities of filing your taxes. But what do they each do exactly? Read on to find out!

What Is IRS Lien Subordination?

IRS lien subordination is an important tool for taxpayers who are struggling with debt. It can help reduce the amount of money owed to the IRS and give a taxpayer more control over their financial situation.

Do 401k Contributions Reduce MAGI?

Retirement planning is an important part of a financial plan, and it starts with knowing how much to save. One way to do this is by taking advantage of 401k contributions and other pre-tax retirement accounts. But do 401k contributions reduce MAGI (Modified Adjusted Gross Income)? What effect do these contributions have on your taxes and savings?

Why Did I Receive a 1099-R?

Did you receive Form 1099-R from the Internal Service Revenue (IRS)? Don’t worry; you are not alone. Every January, the Public Employee Retirement System (PERS) mails IRS Form 1099-R to retirees who received benefits from the year before.

What Is a 1099-K Used For?

If you are a business owner, self-employed, doing extra gigs, selling personal items, or offering products and services that accept payments through credit and debit cards and third-party payment settlement organizations, Form 1099-K is a vital subject that you need to understand.

Benefits of Hiring a CPA

As with any business investment or expense, you want to make sure you’re getting what you’re paying for. The same rings true with an accountant or CPA.

Solo 401(k) vs. SEP IRA: Which is Best for the Self-Employed Individual?

You have successfully survived the start up of your business, and you're now making some money. You know what that means? Taxes! One of the best tax strategies for entrepreneurs is funding a retirement plan. Let's look at two popular options, the Solo 401(k) and the SEP IRA

What is a Schedule K-1?

The tax code is a confusing place for an entrepreneur, and it uses a whole different language. One of the common forms business owners receive is a schedule K-1. So What is a Schedule K-1? Glad you asked! Let's discuss...

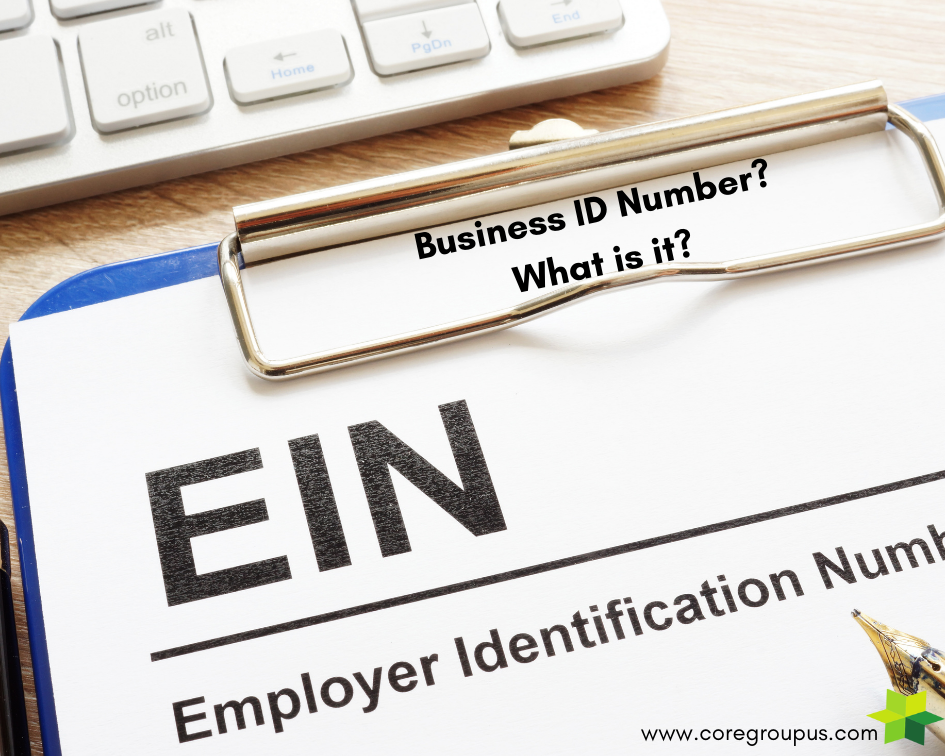

What is a Business Tax ID Number?

What's in a name? Well Business ID Number means different things to different people. Let's discuss the possibilities.

Using TurboTax Vs CPA

Should your business use Turbotax or a CPA to prepare your taxes? You might expect us to say absolutely NOT, but let's dig a little deeper on that.

Pros and Cons of Getting a Tax Extension

There are many reasons you can choose to file an extension for your income taxes. Most likely, you simply need more time to gather all of your information or meet with your accountant. But is there a downside to filing an extension?

Tax Credits vs Tax Deductions: Understanding the Difference

Tax deductions are great, but tax credits are even better! So what's the difference? Glad you asked!

Often Missed Small Business Expenses

You are forgiven for not being able to keep up with all of the changes in small business taxes. It has been a chore to digest everything even for professionals. Here is a recap of recent small business expense changes.

Capital Improvements

Accountants are weird. They use funny words and use lots of spreadsheets. One common word is Capital Improvements. Similar words that they use to describe the same things: Capital Assets, Fixed Assets, Property, Real Estate, FF&E (Furniture, Fixtures, & Equipment). In the accounting tax world, all of these terms describe something with an economic benefit beyond one year.

Hobby vs. Business: What are the Tax Implications

During lean times, people find opportunities to turn their hobby into a few extra bucks. Sometimes those opportunities explode into more possibilities than expected. It doesn’t take long before you ask yourself a reality-check question.

Bunching Tax Deductions

Lots of the old tax rules have changed in the last few years. If you haven't reviewed and adapted, you are likely paying your rich Uncle Sam too much. The Tax Cut and Jobs Act (TCJA) combined the amounts for standard deductions and exemptions into one number. The Act also eliminated deductions entirely. This effectively removed itemized deductions for many tax payers since the standard deduction/exemption for 2020 is $24,800 (married filing jointly).

Employee Retention Credit Expands Under Consolidated Appropriations Act 2021

Previously, I have written about the new round of PPP Loans and the grants for shuttered venue operators that were in the Consolidated Appropriations Act. The Act also extended and expanded the Employee Retention Credit.