The Planner Blog

What’s the Difference Between Standard and Itemized Deductions?

Tax is a perpetually confusing and complicated matter that every individual must understand. If you’re someone who looks at their tax computation with confusion, this blog post might be for you.

Tax Tips for Vacation Rental Owners

Like other forms of real estate, rental properties are subjected to property taxes. However, due to its business nature, taxes apply differently for vacation rental properties. The thing about taxes is that they’re often confusing, and a slight mistake could cause a significant deduction to your income.

How Does Marriage Affect Your Taxes?

How does marriage affect your taxes? Understanding how marriage can alter your taxes can help make sure you get the most out of all available deductions and credits while minimizing any unexpected surprises.

Taxable vs. Non-Taxable Income

Every American citizen is required to pay tax on all income they earn. This rule isn’t limited to your monthly paycheck. It also doesn’t matter whether you received your income in cash, check, goods, or services. As long as your earnings qualify as taxable, then you have to pay your dues in the year you receive your income.

Why Keeping Good Tax Records is Essential

Keeping an accurate log of your deductible expenses, income statements, and receipts is a crucial practice for tax purposes. You want to ensure that filing your tax return goes smoothly, whether it is for personal or business reasons.

Pros and Cons of Filing for a Tax Extension

Everybody's favorite part of business ownership, paying taxes! Yeah right! Sometimes, the deadline just sneaks up on us, so much that over 12 million people filed for extensions this year!

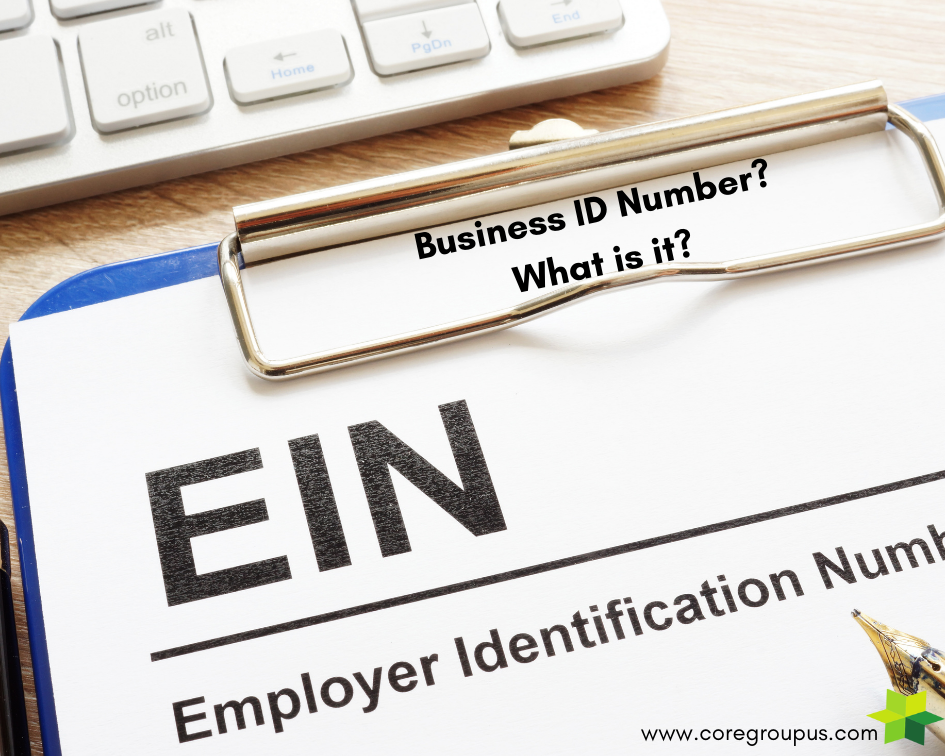

What is a Business Tax ID Number?

What's in a name? Well Business ID Number means different things to different people. Let's discuss the possibilities.

How Long Should You Keep Your Tax Records?

If you're like most Americans, the day that you send off your tax returns is a major relief. But dropping off your tax return isn't the end of the story, because an audit is always possible. If that's the case, you'll need good documentation to prove your return's accuracy.

What You Must Know About IRS Form W-3

As a business owner, being well versed in IRS tax forms and the best ways to record payroll and submit taxes is a crucial skill. IRS forms and adhering to proper FICA (Federal Insurance Contributions Act) standards can be confusing. The IRS does little to illuminate this process, and there is not a lot of simple, concise advice for dealing with taxes.

Estimated Tax Payments

One popular question we hear from our small business clients is if they need to pay estimated taxes. That is followed up with “How much do I need to pay.”

Understanding Amortization and Depreciation

Managing your assets in terms of taxes can seem intimidating at first glance. A simple mistake can cause significant damage to your business. However, understanding concepts like depreciation and amortization can help avoid potential issues in the future. This guide explains the various aspects of amortization and depreciation to help navigate your assets.

Pros and Cons of Getting a Tax Extension

There are many reasons you can choose to file an extension for your income taxes. Most likely, you simply need more time to gather all of your information or meet with your accountant. But is there a downside to filing an extension?

2021 Advanced Child Tax Credits and How it Works

For tax year 2021, the Child Tax Credit increased from $2,000 per eligible child to $3,600 per child ages five and younger and $3000 for children ages six to 17. The amount of Advanced Child Tax Credits is half of the new credit amounts. So, starting July 2021, if you are eligible, you will start to receive monthly Advanced Child Tax Credit payments. If your child is five years old or younger, the payment would be $300 per month through December. That is $1,800, or half of the new Child Tax Credit amount. If you have children between the ages of six and 17, your monthly payment will be $250 per month through December, or $1,500 total.

When to File an Amended Tax Return

You filed your return, and you forgot something, or you realize the return was wrong. How do you fix?

Often Missed Small Business Expenses

You are forgiven for not being able to keep up with all of the changes in small business taxes. It has been a chore to digest everything even for professionals. Here is a recap of recent small business expense changes.

The Vital Pros and Cons of an S Corporation

An S corporation is a type of corporation that meets the specified requirements of the Internal Revenue Code (IRS). An S corporation passes through most of its business income and loss to its shareholders like a sole proprietor. The owners are not liable to pay double tax, at the corporate level and then on the individual shareholder level.

Capital Improvements

Accountants are weird. They use funny words and use lots of spreadsheets. One common word is Capital Improvements. Similar words that they use to describe the same things: Capital Assets, Fixed Assets, Property, Real Estate, FF&E (Furniture, Fixtures, & Equipment). In the accounting tax world, all of these terms describe something with an economic benefit beyond one year.

What Kind of Education Qualifies as a Business Expense?

You're not really getting paid to learn, but it definitely pays to learn.

Bunching Tax Deductions

Lots of the old tax rules have changed in the last few years. If you haven't reviewed and adapted, you are likely paying your rich Uncle Sam too much. The Tax Cut and Jobs Act (TCJA) combined the amounts for standard deductions and exemptions into one number. The Act also eliminated deductions entirely. This effectively removed itemized deductions for many tax payers since the standard deduction/exemption for 2020 is $24,800 (married filing jointly).